Electronic invoicing, or e-invoicing, is revolutionizing the way businesses across the European Union handle their invoicing processes. By replacing traditional paper invoices with electronic formats, companies can streamline operations, reduce errors, fraud and improve overall efficiency.

In this article

What is an e-invoice?

An e-invoice is a digital document that is exchanged between a supplier and a buyer of a product or service in a structured electronic format, allowing for automated processing. Unlike paper invoices or unstructured electronic documents such as PDFs, e-invoices contain data that can be automatically imported into the buyer’s financial system, facilitating smoother transactions and eliminating manual data entry. Additionally, e-invoices are routed based on the company’s registration code or a unique e-invoicing ID code, depending on national and international standards. This ensures that the invoices are correctly attributed to the respective businesses, enhancing accuracy and traceability.

Different e-invoicing solutions

The landscape of e-invoicing solutions is diverse, catering to various business needs. Some solutions are cloud-based, offering the flexibility to access and manage invoices from anywhere. Other solutions provide integration with existing ERP (enterprise resource planning) and accounting systems, guaranteeing error-free data flow and reducing the need for manual data entry.

Additionally, certain e-invoicing platforms offer customizable features, allowing businesses to tailor the solution to their specific requirements. With a wide selection of options available, companies of all sizes can find an e-invoicing solution that aligns with their operational needs and budget constraints.

E-invoice software for machine-readable automation

For those looking to optimize their invoicing processes, e-invoice operator offers features such as machine-readable formats that enable automation. This type of software can integrate with existing ERP systems, automating the creation of invoices, significantly reducing manual effort and the risk of errors. Integrations are not strictly mandatory, and e-invoices can also be sent directly from the e-invoicing software itself.

Keep in mind, that machine-readable formats guarantee that invoice data can be accurately captured and processed by the recipient’s system without manual intervention. These solutions often come with built-in validation checks, making sure that invoices comply with relevant standards and regulations before they are sent. As a result, businesses can enjoy faster processing times, reduced administrative costs, and improved cash flow management.

E-invoice standards in the European Union

The European Union has established a unified standard for e-invoicing, known as EN 16931, to ensure interoperability and facilitate cross-border trade within its member states. By 2028, all businesses must implement processes to receive and issue electronic invoices for intra-community trades. However, while this EU standard provides a common framework, most countries within the Union have previously already developed and followed their own specific standards and requirements. This allows each country to address its unique regulatory and business needs while still aligning with EU directives. However, by 2028, Member States with existing mandatory e-invoicing systems must align their reporting requirements with the pan-European standard.

PEPPOL e-invoicing standard

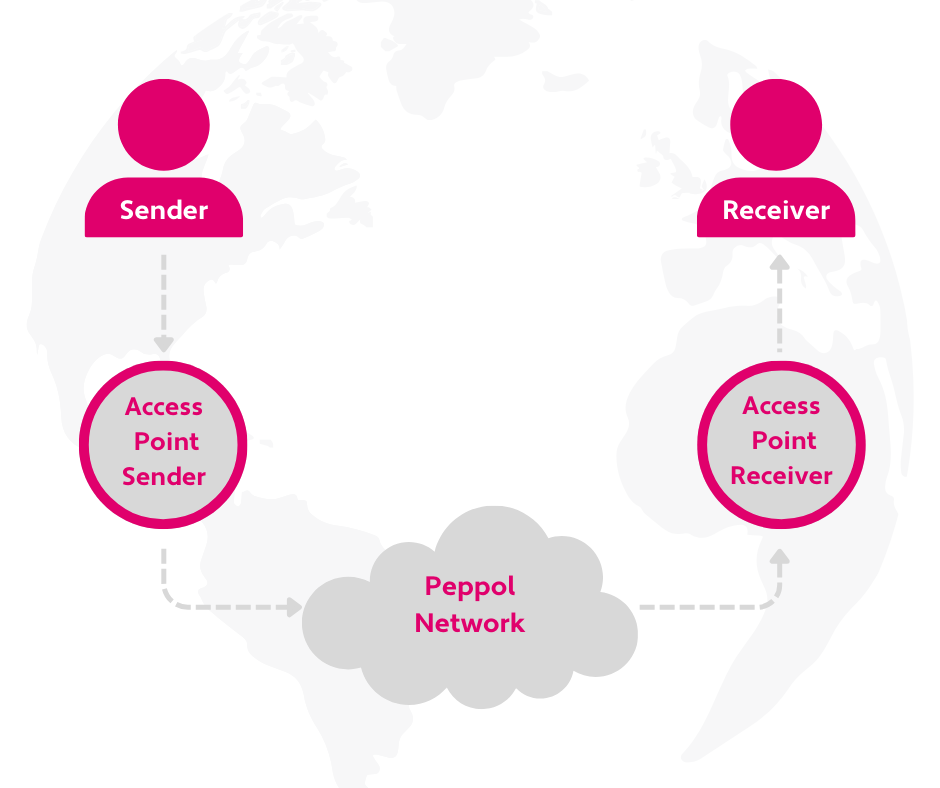

One of the most widely adopted standards is PEPPOL (Pan-European Public Procurement Online). PEPPOL provides a set of specifications that allow businesses to send e-invoices across the EU through a standardized network. This reduces the complexity and cost associated with cross-border transactions and improves the reliability of e-invoicing. PEPPOL’s secure and interoperable framework supports a wide range of business processes beyond invoicing, including ordering and shipping.

The Peppol BIS Billing specification is designed for electronic invoicing and is fully compliant with the EN 16931 standard. The adoption of PEPPOL by many EU countries has led to a more cohesive and efficient digital single market. As more businesses and governments join the PEPPOL network, the benefits of streamlined and standardized electronic transactions continue to grow.

E-invoicing examples – how does the system work?

E-invoicing systems typically follow a structured workflow, here is an e-invoice sample:

- Invoice creation – the supplier generates an e-invoice using their invoicing software, which formats the invoice according to the relevant standard.

- Transmission – the e-invoice is sent through a secure network (such as PEPPOL) to the buyer’s invoicing system.

- Reception – the buyer’s system automatically receives and processes the e-invoice, verifying its authenticity and extracting the necessary data for accounting.

- Payment – once verified, the invoice is approved for payment, and the transaction is completed.

E-invoices in Estonia, Latvia, and Lithuania

Estonia, Latvia, and Lithuania have all embraced e-invoicing as a means to streamline business processes and improve economic efficiency. In Estonia, e-invoicing has become widely adopted, with the government mandating its use for public sector transactions. In May 2024, the government approved a bill amending the Estonian Accounting Act to eventually giving the right to demand e-invoices from partners to all companies, including the private sector from July 2025. Estonia’s advanced digital infrastructure supports the integration of e-invoicing across various sectors, promoting transparency and reducing administrative burdens.

Latvia initially planned to implement regulations making e-invoicing mandatory for B2G (Business-to-Government) transactions starting from January 1, 2025. However, this has now been postponed. According to the new timeline, Latvia will introduce a similar e-invoicing obligation from January 2026 as Estonia did in 2019 – the public sector will only accept and issue e-invoices. The Latvian government aims to encourage businesses to adopt digital invoicing solutions to reduce the time and effort required for invoice processing, improve data quality, and save taxpayer money. Starting from January 1, 2028, the e-invoicing requirement is planned to be extended to the private sector as well, meaning B2B (Business-to-Business) transactions. When it comes to the e-invoice format, Latvia will adopt the international Peppol BIS 3.0 standard from the outset.

Lithuania, following suit, has also mandated e-invoicing for public procurement, aiming to modernize its financial processes and foster a more transparent business environment. Since 2018, the Government of Lithuania has mandated that companies participating in public procurement must submit invoices to purchasing organizations through the Register Center platform “E. Sąskaita”. From 2024 businesses will also be a required to submit electronic e-invoices to the Lithuanian public sector. That can be done through the local platform called SABIS or previously mentioned Peppol network that is used by businesses across the EU.

Across the Baltic States, the shift towards e-invoicing is driven by the need to better accuracy, reduce costs, and facilitate cross-border trade within the European Union.

E-invoicing FAQ

What are e-invoice advantages?

E-invoicing offers numerous advantages over traditional invoicing methods, including:

- Cost savings – reduces paper, printing, and postage costs.

- Speed – accelerates the invoicing process, leading to faster payments.

- Accuracy – minimizes errors through automation and standardized formats.

- Efficiency – streamlines workflows and reduces manual intervention.

- Environmental impact – reduces paper usage, contributing to sustainability efforts.

How many countries have e-invoicing?

E-invoicing is widely adopted in the Baltics and across the European Union. As of now, over 30 countries in Europe have implemented e-invoicing regulations or are in the process of doing so. This widespread adoption highlights the increasing importance of digital transformation in financial operations.

How big is the e-invoicing market in Europe?

The e-invoicing market in Europe is growing rapidly. According to recent reports, the market is expected to reach several billion euros in the coming years, driven by regulatory mandates and the benefits of digital invoicing. This growth is also fueled by the increasing adoption of e-invoicing solutions by businesses of all sizes.

Who requires e-invoicing?

In the Baltics and European Union, several countries have mandated the use of e-invoicing for B2G (Business to Government) transactions. This requirement is part of the EU’s efforts to modernize public procurement and improve efficiency. Estonia has required e-invoicing for public sector transactions since 2019 and Lithuania since 2017. Additionally, many businesses are voluntarily adopting e-invoicing for B2B transactions to reap the associated benefits, such as reduced processing times, lower costs, and improved accuracy. As regulations continue to evolve, it is anticipated that more countries will expand mandatory e-invoicing to B2B transactions, further promoting digital transformation in financial operations.

How to send a free e-invoice?

Sending a free e-invoice can be done using various free or freemium software e-invoicing solutions available in the market. Many platforms offer basic e-invoicing features at no cost, allowing small businesses to start using e-invoicing without a significant investment. Platforms like Finbite provide user-friendly interfaces where users can create and send e-invoices easily.

Send your first e-invoice with Finbite

E-invoicing is transforming the financial landscape across the European Union and in the Baltics. With innovative platforms like Finbite, businesses can optimize their invoicing processes, achieve greater compliance, and enjoy significant operational benefits. As e-invoicing continues to grow in popularity and importance, staying informed and adopting these e-invoice solutions will be crucial for businesses looking to stay competitive in the digital age.

Finbite simplifies the process of sending your first e-invoice. Here’s a step-by-step guide to get you started:

- Register – sign up for a Finbite account on our website.

- Create invoice – use the intuitive interface to create your invoice, filling in all necessary details.

- Select recipient – enter the recipient’s details or select from your contact list.

- Send – click the send button, and your e-invoice will be transmitted securely to the recipient’s system. Finbite supports Estonian e-invoicing standard and international Peppol standard.

Yes, it’s that simple! By leveraging Finbite’s powerful features, businesses can experience the benefits of e-invoicing firsthand, from reduced costs to improved efficiency. Let’s get you started!