Peppol is a fast, reliable and secure way to exchange digital invoices, which is why many businesses in Europe are adopting the Peppol e-invoicing standard. If you want to join the growing number of businesses using Peppol, you’ll want to know exactly how it works and how to set up your business for Peppol e-invoicing in Europe.

Keep reading to learn what Peppol is, how it can benefit your business and how to use Peppol in Europe through certified Peppol service providers like Finbite.

In this article

What is Peppol?

The Peppol environment (Pan-European Public Procurement Online) is a network designed for the international exchange of electronic documents. One of its key functions is to support and facilitate international e-invoicing. Essentially, the Peppol system provides a standardized e-invoice format, allowing service providers like Finbite to convert local e-invoices into a document format that is compliant with the EU e-invoice standard.

All Finbite customers can exchange e-invoices with their international business partners. In order to send and receive invoices through Peppol, it is necessary to activate the channels in advance.

Advantages of Peppol solution

Streamlined international invoicing

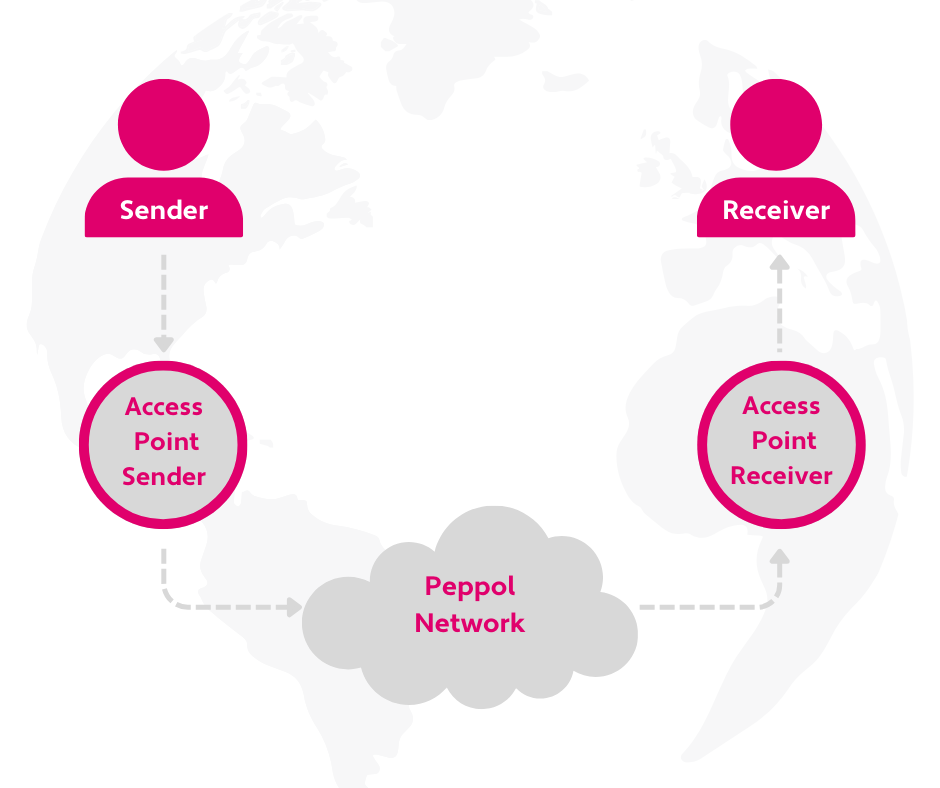

Peppol makes it easy to send e-invoices to companies in other countries. First, send your e-invoice to an access point like Finbite. The access point converts the e-invoice into the Peppol format, then sends it through the Peppol network to the recipient’s access point. In this way, you can send an e-invoice to any international recipient, provided they use a Peppol access point.

Efficiency

A Peppol service provider can convert your local invoice into the Peppol format, making it quick and easy to exchange invoices with entities in other countries. Peppol invoices are 100% digital so there is no need to manually enter data.

Cost savings

Peppol reduces time spent on preparing, sending and receiving invoices, which translates directly to cost savings. Calculate how much you can save by using Finbite for Peppol e invoicing.

Reduced risk

Peppol follows international security standards to ensure network security. With Peppol, only Peppol access points can send and receive invoices and all invoices must follow the Peppol compliant format, preventing fraudulent invoicing. To send e-invoices through Peppol users must also have a registered Peppol ID. This significantly reduces the risk of fraudulent invoices.

Peppol certified service providers in Europe

Peppol service providers create and maintain the infrastructure required to connect to the Peppol network and ensure compliance with Peppol Business Interoperability Specifications (BIS).

Businesses purchase access to the network through the service provider, allowing them to send and receive Peppol invoices without having to become a Peppol access point.

Peppol certified service providers like Finbite are service providers that are members of OpenPeppol, the organization that runs the Peppol framework. Peppol certified service providers are up to date on the latest innovations in the Peppol framework and maintain Peppol’s high security standards.

How to use Peppol for e-invoicing?

Peppol international invoice specification and format

PINT (Peppol International Invoice) is an international invoice specification that simplifies international invoicing by ensuring invoices from all countries are compliant with Peppol specifications. A Peppol service provider can ensure your international invoices are in the PINT format, making for a seamless transaction across borders.

Peppol integration with existing accounting systems

Integrating Peppol into your existing accounting systems makes it easier to send, receive and manage e-invoices. Most accounting software doesn’t directly integrate with Peppol, but Finbite can connect your accounting systems to the Peppol network.

Finbite’s seamless integrations allow for a fast and reliable data flow between the Peppol network and your company’s software. Finbite gives you a complete overview of your invoicing, lets you automate invoicing processes and ensures invoices are compliant with the Peppol e-invoicing standard.

How to send an invoice via Peppol?

Before sending a Peppol e-invoice, you must activate the invoice acceptance feature.

To send a Peppol e invoice from the Finbite Invoice Center, navigate to General -> Invoice Settings -> Sales Invoice Settings.

Next, scroll down to the bottom of the page and select Seller Management -> Modify.

Activate the Peppol channel and click save.

To send a Peppol sales invoice via ERP, you’ll need to add the recipient’s PeppolID to the very end of BuyerParty in the XML. We’ve created an extension specifically for this purpose:

<Extension extensionId=”PartyEN”>

<InformationContent>PeppolID</InformationContent>

<CustomContent>

<PartyEN>

<PartyId schemeId=”0191″>11890209</PartyId>

<PartyElectronicAddress schemeId=“0191”>11890209</PartyElectronicAddress>

</PartyEN>

</CustomContent>

</Extension>

Currently, the extension uses an example recipient PeppolID (0191:11890209). When using the extensions for real Peppol e-invoicing you’ll need to replace this value with the real recipient’s PeppolID.

Receiving e-invoices via the Peppol system

To accept e-invoices via Peppol, log in to Finbite and select General -> Invoice Settings -> Purchase Invoice Settings.

From there, select “Allow invoices from PEPPOL”, tick the checkbox, then click save.

Under settings, make sure that ‘Do not wish to receive e-invoices’ is unchecked.

A PeppolID is then generated for the company, which includes the country code (Estonian code is (0191:)) and the company registration code. Based on this code, cross-border partners can send you fast, convenient, and secure Peppol invoices.

Which solution to choose for sending and receiving international e-invoices?

All Finbite packages offer the option of sending and receiving e-invoices through Peppol. There are four packages to choose from: Starter, Lite, Standard, and Premium.

- With the Starter package, you can send and receive up to 5 e-invoices per month, free of charge, regardless of whether they are domestic or international.

- If you want to integrate Finbite with your business or accounting software and get an overview of all your e-invoices, we recommend the Lite package. In addition, you can use digitization, digital archiving, and submit expense reports to your accountant from the convenience of a mobile app.

- The confirmation circle solution will significantly simplify the accountant’s work, making purchase invoice management more secure and reducing the risk of invoice fraud. In addition to the features mentioned above, this solution is available to users of the Standard package.

- For Premium package users, various additional modules, free initial training, and a personal account manager are also available.

Peppol e-invoicing FAQs

Join Finbite

Exchange Peppol e-invoices with Finbite

Sending and receiving Peppol e-invoices in Europe is easy with Finbite. As a certified Peppol access point, Finbite ensures your invoices meet the Peppol invoice format required for cross-border interactions and keeps your Peppol document exchange safe by adhering to Peppol’s security standards.

Finbite integrates with your business ecosystem, so you can automatically add incoming Peppol e-invoices to your accounting software and send Peppol sales e-invoices with just a few clicks.

Book a demo and learn more about how Finbite can help you with Peppol e-invoicing in Europe!