Digital solutions are already simplifying day-to-day work in many sectors, and now it’s the accountants’ turn. We moved from paper invoices and ledgers to computers and emailed PDFs, but now it’s the e-invoicing era. How convenient and easy is it to receive e-invoices? How to open an e-invoicing channel for your business? Why are e-invoices better than PDFs?

In this article

- Increase efficiency through automation

- Fewer errors and more accurate data with receiving e-invoices

- Faster invoice processing

- Reduce the risk of invoice fraud

- Instead of establishing a new system, improve the existing one

- Accepting e-invoices helps you to stay in competition

- Your partners are grateful

- How to get started?

An e-invoice is a machine-readable invoice that is created, transmitted, validated and stored in a company’s accounting or business software. E-invoices replace traditional PDF invoices as they do not need to be sent by email or manually entered. E-invoices move from one company’s business software to another in seconds via e-invoice operators, making the invoicing process more efficient.

Increase efficiency through automation

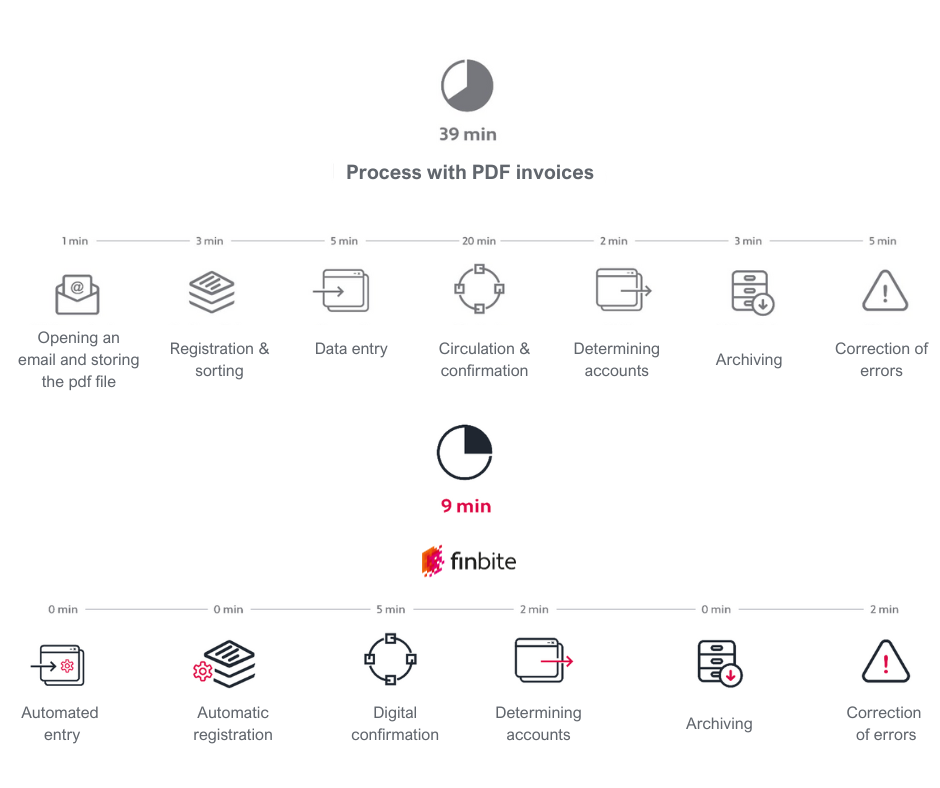

The processing of PDF invoices still requires manual data entry into the accounting system, which is time-consuming and contributes to the risk of data errors. E-invoices automatically move from the accounting system of the sender to the system of the recipient. Accepting e-invoices means that accountants can focus on more important tasks and leave tedious manual invoice entry in the past. It can also automate further steps in invoice management, such as validation and invoicing.

Fewer errors and more accurate data with receiving e-invoices

Have you experienced how much confusion can be caused by incorrectly entered invoices? Receiving an e-invoice completely eliminates the problem of manually entering data. All the data on the invoice moves automatically, leaving errors in the past. This means more reliable and accurate accounting.

Faster invoice processing

E-invoices arrive instantly in your business software or accounting system. This, in turn, speeds up the entire invoicing process. This means faster processing and payment of invoices, and a better overview of cash flow. In addition, partners are happy to receive payments on time or even earlier.

For example, the vast majority of large utility and communications companies whose services you use are already adopting e-invoicing. This means that when you open an e-invoicing channel, you no longer need to manually enter, for instance, several pages of invoices for your company’s monthly phone bills, as they can be instantly found and processed in the e-invoicing system. The processing part is also made faster by other smart invoice management solutions that Finbite offers.

Reduce the risk of invoice fraud

PDF invoices can be exposed to security risks, especially when sent by email. Scammers will often find a way to hack into a company’s email server and monitor vendor-purchaser correspondence without them realising that a third party is involved. However, once the communication has reached a stage for billing, the scammers take control of the communication and submit invoices with false bank references.

E-invoices move between systems by company registration code, not by email. Security is also ensured by the fact that invoices are encrypted in the operators’ network and access to invoices is restricted to users with limited rights. It will also be possible to send all purchase invoices to the confirmation circle.

Instead of establishing a new system, improve the existing one

E-invoicing solutions are easy to integrate with accounting and business software. Finbite interfaces with all the most popular ERP software in the Baltics, ensuring fast and secure connectivity and smooth data flow. This means you can continue to use your existing systems and workflows when receiving e-invoices, while enjoying the benefits of smart solutions. For example, you can apply automated templates for e-invoice account and cost allocation because the data is machine-readable.

Accepting e-invoices helps you to stay in competition

In many European countries, including Estonia, the use of e-invoicing is already mandatory for public sector and procurements. It is expected that all companies providing services or goods to public authorities and enterprises will have the capacity to send and receive e-invoices. E-invoicing will help businesses to increase their competitiveness and comply with local regulations.

Your partners are grateful

If your company’s partners already have e-invoicing capability, it’s worth switching from PDF invoices to e-invoices on a mutual basis. This can lead to smoother collaboration and stronger business relationships, which benefits all parties.

How to get started?

Opening an e-invoice channel and receiving an e-invoice from a partner is easy. Finbite offers comprehensive solutions to meet the needs of businesses of all sizes and at all stages of growth. In addition to e-invoices based on Estonian E-invoice Standard, you can also exchange e-invoices in Peppol format through the Finbite environment.

First select the package that suits you and send us an enquiry. We will then open an account for your company and you can activate your e-invoice traffic.