Is requesting e-invoices merely a convenience, a legal right, or a clear sign that the digital era has truly arrived? Starting July 1, 2025, new regulations in Estonia gave all businesses the legal basis to request e-invoices. But what does this mean in practice? How do you request them correctly, and does the right to ask for e-invoices also imply an obligation to send them?

In this article:

- What Is an E-Invoice and Why Does It Matter?

- Who Has the Right to Request an E-Invoice?

- How to Activate E-Invoice Reception

- Is Sending E-Invoices Mandatory?

- A Practical Guide: How to Request an E-Invoice

- Why You Should Start Requesting E-Invoices Today

- A Seller’s Guide: What to Do When a Partner Requests an E-Invoice

- E-Invoices Are Here to Stay

In this article, we’ll explain what an e-invoice is, who can request it, whether e-invoicing is mandatory for everyone, and how companies can prepare to send and receive e-invoices efficiently.

What Is an E-Invoice and Why Does It Matter?

An e-invoice is not an invoice sent by email. It’s a machine-readable XML document that moves directly between accounting systems. No manual input, no human error. All invoice data, including dates, line items, and VAT details, are transferred automatically into the recipient’s accounting software.

📌 E-invoice ≠ PDF invoice

While a PDF is digital, it’s not machine-readable. E-invoices, on the other hand, flow seamlessly from one system to another. Without the “copy–paste” steps in between. The result: faster workflows, fewer errors, and more transparent data exchange between business partners.

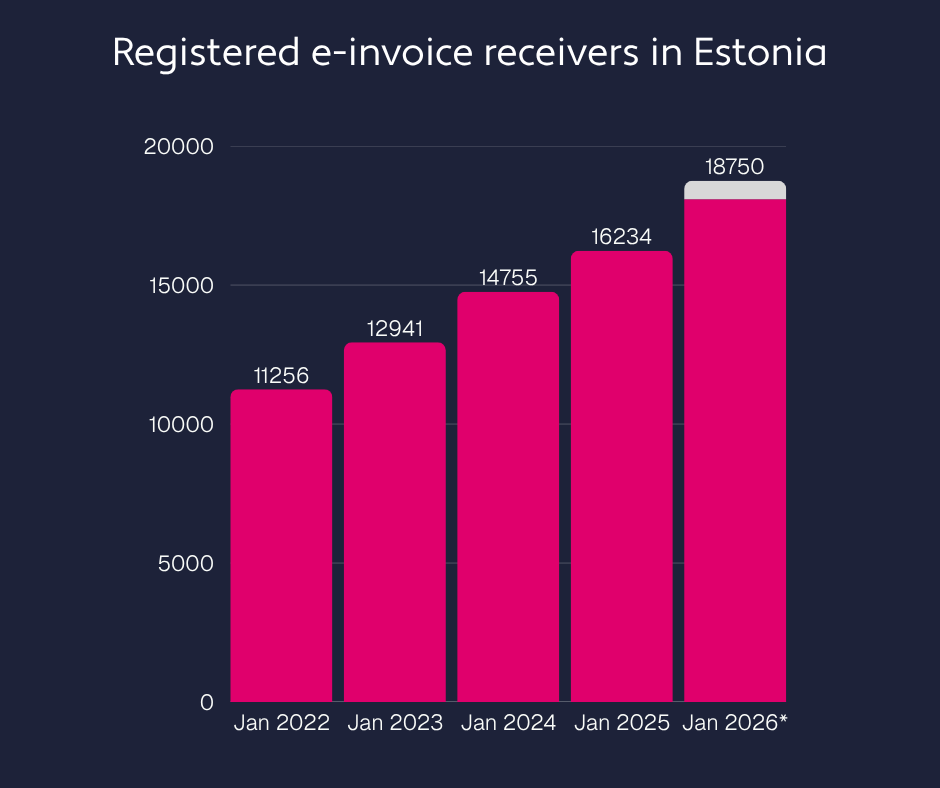

Although e-invoices have been available in Estonia for years, full digital adoption between businesses hasn’t yet been achieved. Currently, only around 23% of B2B invoices are exchanged electronically, and just 11% of active companies are registered as e-invoice recipients.

Despite steady growth, adoption is still slow. Most companies use a hybrid model. They send e-invoices but continue to receive PDFs by email. True efficiency, however, only emerges once a company enables both sending and receiving of e-invoices.

Receiving e-invoices is a logical next step. When invoices arrive directly in your accounting system, you eliminate manual data entry, reduce errors, and save valuable time. With the upcoming legal changes, there’s no better moment to activate e-invoice reception, it’s where real automation and competitive advantage begin.

Who Has the Right to Request an E-Invoice?

Until now, only public sector entities were legally required to demand e-invoices. Starting July 1, 2025, however, the amended Accounting Law extends this right, not obligation, to all accounting entities registered as e-invoice recipients in the Business Register.

In practice, this means that if your company is listed as an e-invoice recipient, you have the legal right to request e-invoices from your partners. Some interpret this as an implicit expectation that all invoices sent to such companies should already be in e-invoice format.

How to Activate E-Invoice Reception

It’s important to clarify: this change does not mean all businesses must start sending e-invoices immediately. The obligation applies only when the recipient requests an e-invoice. So, the buyer holds the right, and the seller carries the obligation once the request is made.

Is Sending E-Invoices Mandatory?

One of the most common questions businesses ask is whether e-invoicing will become mandatory.

The answer is not yet, but it’s clearly the direction we’re heading.

Sending e-invoices becomes mandatory only when the buyer requests it. After July 1, 2025, no company (including public sector entities) is required by law to make such a request, but any company that has registered as an e-invoice recipient has the right to do so.

In other words, e-invoicing will be demand-driven and voluntary, relying on mutual agreement between business partners. That said, companies should already start preparing their systems, processes, and teams for this new digital normal.

A Practical Guide: How to Request an E-Invoice

Many companies aren’t sure where to start. Here’s a step-by-step guide for requesting e-invoices professionally and efficiently.

1. Explain the “Why”

When reaching out to partners, clarify why you prefer e-invoices:

- It’s faster and more secure

- It reduces manual work and human error

- It aligns with new legislation

Optionally, include a link to Finbite’s resources on e-invoice requests.

2. Specify the Technical Details

Indicate through which operator (e.g. Finbite, Bilnex) you receive e-invoices. E-invoicing in Estonia operates under a roaming principle, meaning invoices can be exchanged between different operators. For example, Bilnex by Finbite allows businesses to send unlimited e-invoices and PDFs for free, a convenient selling point to include in your message.

3. Add the Requirement to Contracts

When signing new contracts or updating existing ones, include a clause stating that all invoices must be submitted as e-invoices, following the recipient’s specified standard. This ensures clarity and prevents format disputes later.

4. Automate the Response

If a partner still sends you a PDF, set up an automatic reply like this:

Subject: Please send future invoices as e-invoices

Hello,

Thank you for your invoice. Following the Accounting Act amendment effective July 1, 2025, we kindly ask you to send all future invoices as e-invoices.

What changed?

The new regulation allows all companies registered as e-invoice recipients in the Business Register to request invoices in e-invoice format.

What is an e-invoice?

An e-invoice is a machine-readable XML document that moves directly between accounting systems with no manual input required.

How to send us an e-invoice:

You can send e-invoices from your accounting software, via Finbite, or through any other e-invoice operator.

Thank you for helping us streamline our accounting processes and reduce manual work.

Best regards,

[Your Name & Title]

5. Support Your Partners

Some smaller partners may not yet use e-invoicing systems. Offer them support. Share guides, recommend tools, or suggest service providers that can help them transition smoothly.

Why You Should Start Requesting E-Invoices Today

- Cost Efficiency:

While e-invoicing services may charge a small fee, the time savings quickly outweigh the cost. Processing an e-invoice is on average €0.03 cheaper and 30 minutes faster than handling a PDF manually. - Time Savings:

Data transfers automatically between systems, eliminating double entry and freeing up time for higher-value work. - Accuracy:

Machine-read invoices reduce the risk of human error. - Sustainability:

Less paper, fewer digital attachments, and more structured, reusable data. - Future-Readiness:

E-invoicing is becoming the European standard for both B2B and B2G transactions.

A Seller’s Guide: What to Do When a Partner Requests an E-Invoice

If a client requests an e-invoice, don’t view it as a burden. It’s a clear signal that your business is evolving alongside the market.

1. Find the Right Software

As of July 2025, all registered accounting entities have the right to request e-invoices. If a client invokes that right, you should be able to comply. Fortunately, it’s simpler and cheaper than it sounds.

For instance, Bilnex by Finbite allows unlimited free e-invoice and PDF submissions. Setting up an account takes just minutes, and the platform auto-fills most invoice data for you.

You can also check whether a client accepts e-invoices before sending.

If you prefer integrating e-invoicing directly into your accounting software, Finbite offers solutions compatible with all major Estonian ERP and accounting systems.

2. Inform Your Team and Update Processes

If multiple team members handle invoicing:

- Update internal guidelines

- Note which clients require e-invoices

- Automate e-invoice routing where possible

- Align formats and expectations in your contracts

This minimizes confusion and ensures consistency.

3. View It as an Investment in Client Relationships

E-invoicing isn’t “just another requirement”. It’s an opportunity to enhance professionalism and efficiency. You’ll get paid faster, reduce manual work, and present yourself as a modern, trusted business partner.

E-Invoices Are Here to Stay

Requesting e-invoices is no longer a passing trend, it’s becoming a new business standard across Europe. From July 2025, every Estonian company registered as an e-invoice recipient will have the right to demand e-invoices. This shift fosters efficiency, and transparency for businesses of all sizes.

If e-invoicing has seemed complicated, it’s really just one quick step toward smarter, more automated business operations.The sooner you start, the smoother your transition will be.