Is your team wasting countless hours searching for PDF invoices? Are payments to vendors being delayed while you chase down invoice approvals?

If so, you’re not alone. Manual invoice approval is a bottleneck for many businesses, draining valuable time and resources.

In this article

- What is an AP invoice approval workflow?

- Why should I automate my accounts payable approval process?

- How to build an automated invoice approval system

- Examples of automated AP approval processes in the Baltics

- FAQ: Invoice approval automation

- How does automated invoice validation work?

- What is the best invoice approval process software?

- How do SharePoint invoice approval workflows compare to Finbite?

- How do SAP invoice approval workflows compare to Finbite?

- Can I process invoices remotely with Finbite?

- How can I automate invoice matching and approval workflows?

- Automate your invoice approval process with Finbite

Fortunately, invoicing tools like Finbite can automate the entire accounts payable process. Automated approval workflows eliminate manual data entry, reduce errors, and streamline communication between departments – freeing your team to focus on tasks that will grow your business.

In this step-by-step guide, we’ll show you how to automate your invoice approval workflows. We’ll discuss the key steps involved in AP automation, including invoice capture, setting approval rules, and using invoice confirmation circles. We’ll also share real-world examples of successful AP automation in the Baltics.

What is an AP invoice approval workflow?

An AP (accounts payable) invoice approval workflow is a process where purchase invoices are verified and approved before they are paid. The accounts payable invoice approval process typically begins when an invoice is received. Incoming invoices are categorized and sent to an employee who is assigned to approve invoices. The employee then reviews the invoice details and amounts. If they approve the purchase invoice, it can then be paid and stored.

Why should I automate my accounts payable approval process?

Drawbacks of manual invoice approval

Manual AP approval processes make reviewing and approving purchase invoices a time-consuming task. Without automation, employees must send purchase invoices to accounting via email, wait for confirmation, and manually send reminders for unpaid invoices.

This approach results in slow processing times, data entry errors, and misplaced documents. Communication through email also delays the approval process, directly impacting business operations and vendor relationships. In addition, businesses exchanging PDF invoices through email are more susceptible to invoice fraud.

Benefits of automation

Automating invoice approval workflows resolves these challenges. Automated invoicing systems like Finbite can automatically capture purchase invoices using OCR technology and then digitize them into a machine-readable format. By automatically converting incoming invoices, businesses can significantly reduce invoice processing time and eliminate entry mistakes.

Once the invoice is in the Finbite system, it can be sent to a designated employee (confirmer) for confirmation, based on preset invoice confirmation templates and rules. The confirmer can then approve the invoice in seconds from any smart device. Afterwards, the invoice can be safely stored in Finbite’s digital archive for easy access. Benefits of this automated payment approval process include:

- Time and cost savings: Automation saves time, resources, and reduces mistakes like duplicate invoices or incorrect data entry.

- Faster employee reimbursements: Employees can get reimbursed faster for any out-of-pocket expenses, as submitting expense reports and receiving approval takes only a few minutes.

- Increased productivity: Employees spend less time on invoice submission and approval and have more time to focus on activities crucial to the business.

- Improved relationships with suppliers: Invoices can be approved and paid in minutes, and automated reminders ensure that no unpaid invoices are left behind.

- Complete oversight of the invoicing process: With a digital archive, businesses can easily access past invoices at any time.

How to build an automated invoice approval system

To build an automated invoice approval system that is fast, simple, and secure, businesses must consider the following invoice verification process steps.

Capture and digitize invoices

Capturing invoice data is essential for any automated invoice approval process. Businesses can use Finbite to automatically capture invoice data, eliminating manual data entry. Finbite uses OCR technology to digitize PDF and paper invoices into a machine-readable format. Together with human verification, Finbite ensures 99% invoice accuracy. After the invoice has been converted into a machine-readable format, it can move quickly and securely through the Finbite environment.

Set automated approval rules

A clearly defined approval policy ensures all incoming purchase invoices are processed correctly. Automated approval workflows ensure only legitimate invoices are approved and that only employees with the right credentials are allowed to approve certain invoices. Automated systems can protect businesses from unauthorized payments and help control spending.

Finbite makes it easy to set invoice approval rules. For example, users can create rules that all incoming invoices must be approved by two or more employees, depending on the invoice amount.

Users can also set approval limits for each employee. When an invoice is routed for approval, the system checks if the invoice amount (excluding VAT) falls within the set limit. If the invoice amount exceeds an employee’s approval limit, it’s forwarded to a confirmer with a higher approval limit. Automated approval rules streamline workflow invoice processing and eliminate unauthorized approvals on large purchases.

Create an invoice authorization process

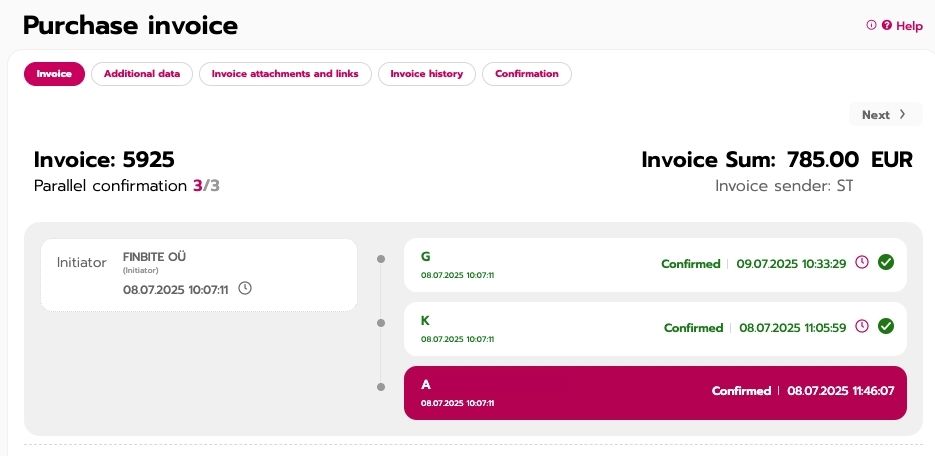

Having an efficient invoice authorization process is an essential part of invoice approval. Finbite allows users to set up an easy invoice authorization process through its digital invoice confirmation circle.

Through this feature, users can submit machine-readable invoices through the Finbite system. Depending on the preset approval limits, the invoice is routed to the appropriate employee for confirmation.

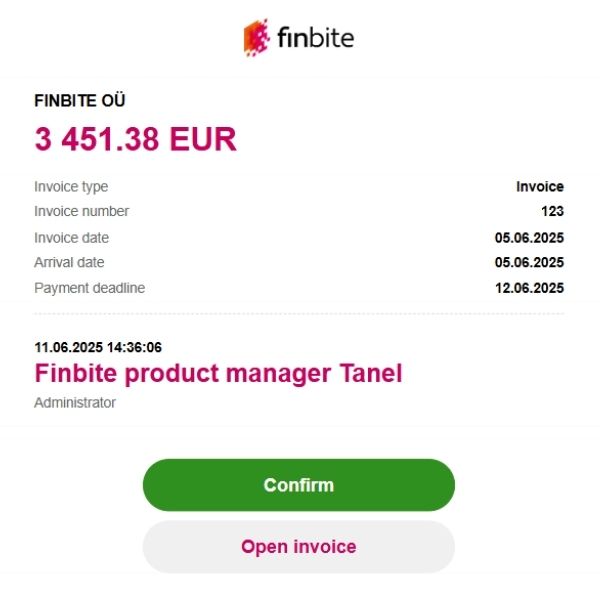

The confirmer can then easily view the invoice in the Finbite system and confirm it with just a few clicks. Employees can confirm invoices from any smart device – mobile, tablet, or PC. Finbite’s invoice confirmation circle also gives each party a clear overview of invoice details and amounts.

In addition, Finbite can automatically send recurring purchase invoices to the same confirmer as soon as they enter the system. One-off invoices can also be confirmed with just a few clicks. Finbite also allows businesses to send automatic emails to confirmers, notifying them when their confirmation is needed.

This paperless invoice approval system streamlines the invoice approval process. It allows employees to submit expense reports when out of the office, automates payout approvals, and eliminates back-and-forth communication between employees.

Track invoice status

While the goal of automation is to reduce manual work, it’s important to be able to monitor invoice status during the invoice review process.

Finbite gives users a complete overview of all invoices. Employees can view data regarding purchase invoices, sales invoices, expense reports, and confirmation processes, all within the Finbite ecosystem. Users can also view invoice status by sender or recipient, and see whether an invoice has been received, confirmed, or is pending confirmation.

Finbite can also send automatic reminders to employees after a set time period, asking for confirmation of pending invoices. In addition, businesses can add substitute confirmers. When an employee is away on vacation or sick leaver, Invoices will are automatically rerouted to the substitute confirmer for confirmation. This leaves the automated system uninterrupted at all times.

Integrate the approval process with existing ERPs

Without proper integration, businesses must manually transfer data between systems. This manual data entry is time-consuming and can lead to errors in reporting. Automated invoice processing and approval software solves this problem by enabling automatic invoice data flow between systems.

For example, after an invoice has been received and confirmed through Finbite, the invoice data moves directly into the user’s existing accounting system (eg Merit Aktiva or SimplBooks). Then, invoice data is exported from the ERP to the company’s bank for payment. This integration creates a unified ecosystem where all financial data is exchanged seamlessly between systems, giving businesses a comprehensive view of all accounting data and invoice payments.

Examples of automated AP approval processes in the Baltics

Many companies in the Baltics have successfully implemented automated invoice approval workflows. Examples of AP automation in the Baltics include:

JCDecaux Lithuania: JCDecaux is a global outdoor media company operating in the Baltics. Instead of manually sending invoices to employees for approval, JCDecaux Lithuania now uses automated approval templates for purchase invoices. Employees receive automatic notifications when they need to approve an invoice and can quickly confirm invoices from any device. According to Audrė Bučinskienė, CFO of JCDecaux Lithuania, this automated approval process saves time for employees.

Omniva: Omniva, an Estonian postal and logistics service provider operating across the Baltics, uses Finbite to streamline its electronic invoice approval process. Finbite’s invoice confirmation circle has simplified the way they handle both incoming and outgoing invoices, making their approval workflows more efficient.

FAQ: Invoice approval automation

How does automated invoice validation work?

Businesses use solutions like Finbite for invoice validation and approval automation. Finbite automatically verifies invoice data, checks for duplicate invoices, matches purchase orders, and validates tax rates and calculations.

What is the best invoice approval process software?

Finbite stands out as the best invoice approval workflow software. Its simple, intuitive interface allows employees to easily capture, digitize, and submit purchase invoices from any smart device. Users can create automated invoice confirmation circles with designated confirmers and automated approval limits. Finbite’s all-in-one invoicing system also gives users complete oversight of AP invoice approval workflows.

How do SharePoint invoice approval workflows compare to Finbite?

SharePoint is a document management system. Businesses can use SharePoint to set up basic invoice approval processes, but this requires significant customization and technical expertise. On the other hand, Finbite is a purpose-built, ready-to-use solution specifically designed for automating invoice approval, with local support and pre-built integrations that make it significantly easier to set up automated invoice approval workflows.

How do SAP invoice approval workflows compare to Finbite?

SAP offers robust invoice processing but comes with high implementation costs and complexity that often exceed the needs of SMBs. Finbite is a more cost-effective, streamlined solution for businesses in the Baltics. Finbite is easy to implement and has a simple user interface, delivering enterprise-level automation without the complexity of SAP AP invoice approval workflows.

Can I process invoices remotely with Finbite?

Yes, Finbite is an easy-to-use platform that can be used on any smart device. Employees can conveniently capture receipts and submit an expense report through the Finbite app. Employees can view and confirm invoices from their smart device, ensuring invoices are paid even when out of the office. With Finbite’s invoice review and approval process, invoices can be submitted and paid immediately, regardless of where employees are located.

How can I automate invoice matching and approval workflows?

Finbite’s invoice approval process software automatically compares invoice numbers and supplier details against invoice history to eliminate duplicate invoices. It also matches invoices against purchase orders and goods received notes in your ERP system.

Automate your invoice approval process with Finbite

Automated invoice approval workflows with Finbite can transform your accounts payable approval process from a liability into a competitive advantage. Through Finbite’s invoice automation workflows, you can process invoices faster, reduce errors, and build stronger vendor relationships through timely payments.

Ready to eliminate manual AP tasks that are limiting your business? Finbite’s purpose-built platform offers an intuitive, cost-effective solution that integrates seamlessly with your existing systems.

Book a demo today to start automating your invoice approval process with Finbite.