In today’s digital landscape, businesses are continually seeking ways to streamline operations and enhance efficiency. And this means nothing without measurable results based on KPIs. One powerful tool that has revolutionized invoice processes is the adoption of e-invoices and digitisation of invoices and receipts. Moving away from traditional methods such as emails, PDFs, and paper invoices, e-invoices offer numerous savings and benefits that extend far beyond mere cost reduction.

Contents

Understanding the Key Differences: PDF Invoices, Digitized Invoices, and E-Invoices

PDF invoices are electronic representations of traditional paper invoices that are commonly created using softwares like Excel or accounting programs and saved in PDF format for distribution via e-mails. While they offer the convenience of electronic delivery and storage, PDF invoices often still require manual handling and processing. Unlike digitized or e-invoices, PDF invoices do not inherently facilitate automated data exchange between systems, and they still need manual data entry into accounting or enterprise resource planning (ERP) systems, leading to ineffective and error-prone invoicing process.

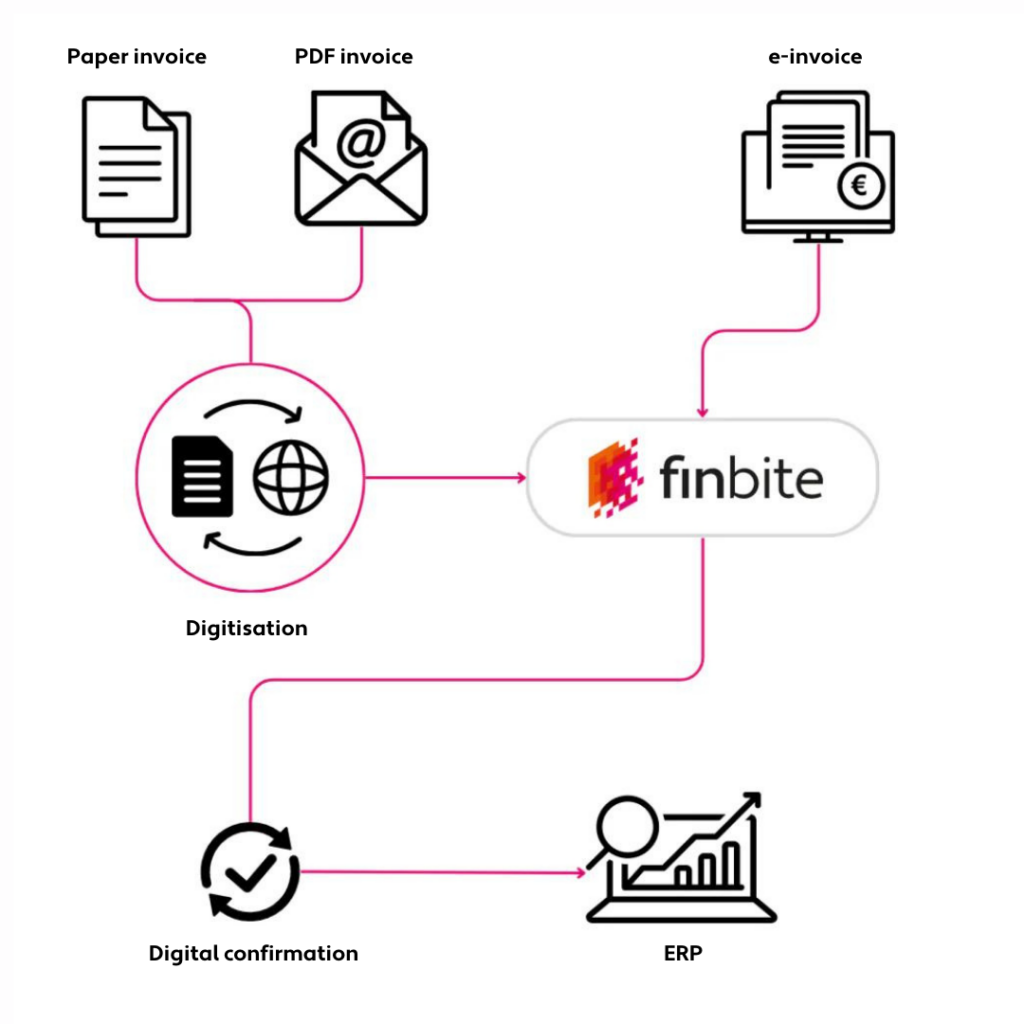

Digitizing PDF invoices into e-invoice format involves transforming static PDF documents into structured electronic files compatible with e-invoicing systems. This process typically entails converting the visual content of PDF invoices into machine-readable data through optical character recognition (OCR) technology. Once digitized, the invoices are restructured into standardized electronic formats such as XML or EDI (Electronic Data Interchange), which enable seamless integration and automated processing within business systems. By converting PDF invoices into e-invoice format, organizations can unlock the benefits of streamlined invoicing workflows, reduced manual intervention, and enhanced data accuracy. This digital transformation empowers businesses to leverage some of the potential of e-invoicing solutions without switching fully to e-invoicing. This can help drive efficiency gains and cost savings across the invoicing process.

E-invoices, or electronic invoices, represent the modern pinnacle of digital invoicing solutions. These invoices are generated, transmitted, and processed electronically, without the need for exporting large PDFs and sending them via email. Unlike PDF and digitized invoices, e-invoices are created and exchanged in structured electronic formats such as XML or EDI (Electronic Data Interchange), facilitating automated data exchange between trading partners and systems. E-invoices offer the highest level of efficiency, accuracy, and automation in the invoicing process, resulting in cost savings, faster processing times, and reduced errors compared to traditional paper or electronic invoicing methods.

Understanding the Savings and Benefits of Switching to Digital Invoicing

The transition to e-invoices may seem daunting at first, but the rewards are well worth the initial investment. By embracing true system-to-system digitalization, businesses stand to gain significant advantages. The primary savings and benefits include:

- Elimination of Manual Tasks: With e-invoices and invoice digitisation, the need for manual intervention is greatly reduced or eliminated altogether. This not only saves time but also minimizes the risk of human error, leading to greater accuracy in financial transactions.

- Reduction in Expenses: By shifting from PDF-based invoice handling to e-invoices, businesses can realize substantial cost savings across various fronts. Unlike PDFs, which often require e-mailing or printing for physical storage, e-invoices offer a streamlined solution that significantly reduces operational expenses. The manual handling of PDF invoices, including e-mailing, data entry and archiving consumes valuable time and resources. In contrast, e-invoices streamline the entire invoicing process, automating tasks such as delivery, entry, and archiving. This not only improves efficiency but also reduces the labor costs associated with manual invoice management.

- Enhanced Data Quality and Accuracy: One of the often-overlooked benefits of e-invoices is the improvement in data quality. PDF invoices are susceptible to errors during manual data entry or processing, leading to potential financial discrepancies and additional costs associated with error correction. By digitizing invoices or sending e-invoices from one accounting system straight to another, businesses can ensure that information is captured and processed with utmost precision, paving the way for informed decision-making and strategic insights.

Additional Automation Opportunities for Digital Invoicing

When the invoices are kept in digital machine-readable format, it offer multitude of further automation possibilities. As Finbite offers digitisation of paper and PDF invoices as well as receipts, you can automate a big part of your accounting work-flows.

- Automated confirmation processes based on templates. With the confirmation circle, purchase invoices and expense reports can be confirmed quickly, conveniently and securely by employees. It also allows accountants to keep an eye on who has or hasn’t approved an invoice and when. You can automate who has to confirm certain invoices, in which order and set up automatic reminders if the progress gets stuck. The possibility to set a limit on the amount to be authorised for employees or the obligation to add a contract number to the invoice helps to reduce the risk of invoice fraud. During poplar vacation periods, confirmers can appoint a replacement or a substitute who has the rights to approve their invoices.

- Automated account allocation based on templates. You can automate the account allocation for purchase invoice rows. This makes the processing of recurring invoices much faster, especially if they have a lot of rows. Good example of this is company’s phone bill with cost rows based on phone numbers that should be allocated under different departments.

- Digital expense reporting allows you to take a picture of a receipt immediately after purchase and enter it as an expense report into your company’s invoicing environment. There is no need to collect paper receipts, deliver them to your accountant, sort and store them, as the whole process is digital. As a result, the sum shown on the expense report reaches the submitter’s bank account 6 times faster than with a paper-based system. You can submit the expense reports with Finbite Finance app or through your web browser.

- Digital archive saves office space and paper, and provide convenient and fast access to documents. Access to the digital archive is restricted to authorised company staff and the security of documents in the database is guaranteed.

Key Performance Indicators (KPIs) of Switching to Machine-Readable Invoices

To gauge the success of your e-invoicing initiative, it’s crucial to establish relevant KPIs and metrics. These not only serve as benchmarks for progress but also help in identifying areas for improvement.

There’s usually more than one employee included in the invoice management process. Purchase contact receives the invoice to their mailbox and hopefully forwards it to accounting in a timely manner. Then it gets manually entered by an accountant and processed. In order to reduce risk of errors and invoice fraud, the invoice needs to confirmed by all necessary internal parties – usually the purchase contact, manager and chief accountant. Then it’s checked once more before it gets paid and archived. This process is different from company to company but gives a perfect example of how many employees are concerned when it comes to processing a single invoice. This all takes up a lot of time and focus on process management when everything is done on paper or through email, because none of it can be automated and mistakes are easy to come along.

Here are some key metrics to consider throughout this process:

- Cost per Invoice: Measure the average cost for processing each invoice, comparing it to traditional methods to assess cost savings. Keep in mind the amount of people involved in the process, their wages, costs for archival etc.

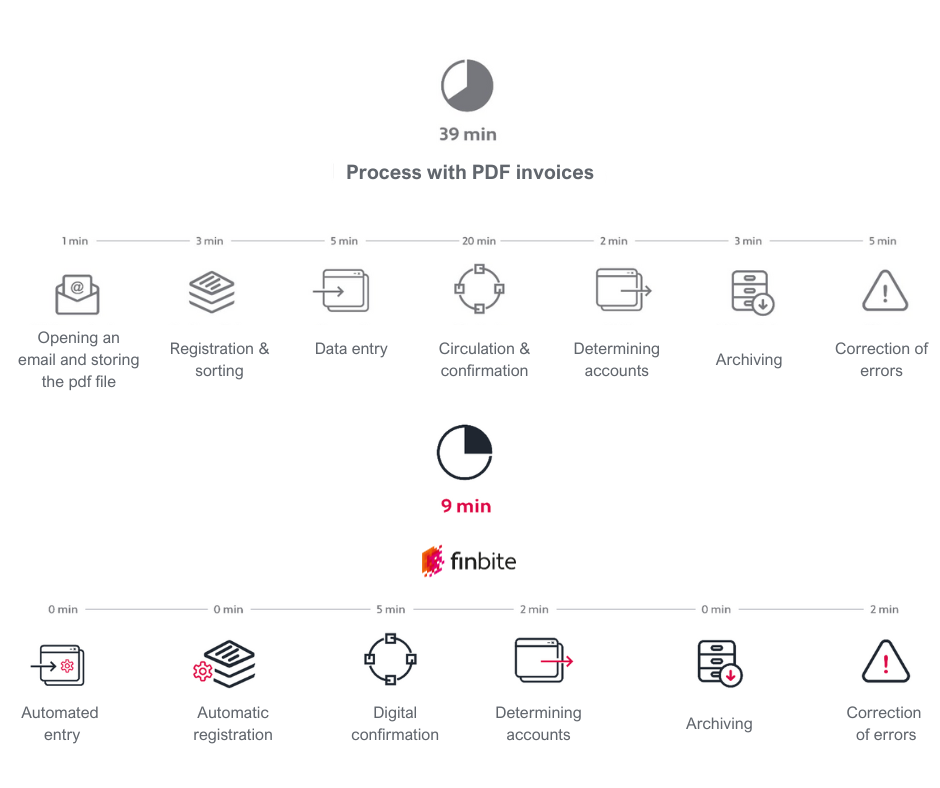

- Time Spent per Invoice: Track the time spent on invoice processing tasks, highlighting efficiencies gained through automation.

- Invoices Processed per Full-Time Employee: Evaluate the productivity of your workforce by analyzing the number of invoices handled per employee.

- Staff Satisfaction Level: Monitor employee satisfaction to gauge the impact of e-invoicing on job satisfaction and morale. Give your staff more time to focus on their main tasks that add value to the company.

- Days Sales Outstanding (DSO): Assess the efficiency of accounts receivable processes by tracking DSO, aiming for faster invoice settlement. As the invoices reach your customers systems faster and the processing can be automated, the invoices get settled faster.

- Straight-Through Processing Rate for Accounts Payable: Measure the percentage of invoices that can be processed without manual intervention, indicating the efficiency of your AP workflow.

- Reduced Error Handling: Quantify the time spent and frequency of errors encountered, showcasing improvements in accuracy and reliability.

- Reduced CO2 Emissions: Highlight the environmental benefits of e-invoicing by calculating the reduction in carbon emissions associated with paper-based archival processes and storage of big PDF files in multiple mailboxes simultaneously.

- Value of Data: Identify potential cost savings or revenue opportunities through the analysis of reliable data enabled by correct and timely collection.

How much would you save with digital purchase invoice management?

Conclusion

In conclusion, the switch to e-invoices presents an opportunity for businesses to unlock efficiency gains and drive bottom-line results. By leveraging the right metrics and KPIs, organizations can effectively measure the savings and benefits derived from digitalizing invoice handling processes. Embracing e-invoicing isn’t just about cutting costs; it’s about paving the way for a more agile, sustainable, and future-ready business model. Start your journey towards digital transformation today and reap the rewards of streamlined invoice management.